The next year can bring some unwanted gifts that can be unwrapped if the government doesn't take action. These include a smaller pay check, cuts on Medicare and tax increases on investments. Whether these events take place or not it is best to hedge, stocks may be in for the roller coaster ride we experienced in summer 2011 as another credit downgrade for the U.S. may be just around the corner. We have already been downgraded harshly by China's Dagong Global Credit Rating Co in 2010-11. Whether you have no clue about the world of finance or are financially literate following a few steps to free yourself of worries and doubts is a good way to start the new year. Why don't you stuff the following steps down your newly emptied Christmas stockings:

1. Be Frugal

It all starts with freeing money to pursue activities/investments you like. There are things we can't avoid such as rent, mortgage, food, clothes and utilities but even these can be played around with. Try to shop for deals and get in the habit of buying items that can easily be resold once you don't need or want them anymore. Open up an eBay account to resell items. Take advantage of the close to free sites you can make money from such as YouTube, Gumroad and T3Media. It's not a crime to be cheap it's a gift for those who possess it.

2. Save

Try to save as much as you can from every paycheck or monetary gift. If you are in debt get rid of it as soon as possible there is no point in giving companies so much of your hard earned money in the form of high interest rates. You need to save to feel safe and to give yourself breathing room as you don't want to have the feeling of going to work and knowing that if you lose your job you will be in deep financial trouble, get rid of the paycheck to paycheck lifestyle. You don't want to give anybody that much power or control over you. Financial troubles are one of the top reasons couples argue, the risk of family violence is greater when the family's income level is low.

3. Invest

By following step 1 and 2 successfully you are now ready to invest. It doesn't really matter what you do for a living or even the name of the company where you work at with the right mentality you can multiply your money. The younger you start the more time you have to let the money pile up. You have to take risk in order to enjoy the finer things in life. Yes, 401k's are fine but why not learn about investing by opening up your own stock trading account. When other people manage your money for you it doesn't put you in the position of control as when you do the investing yourself. A business, real estate, more education and futures contract trading are other forms of investing that you may want to try. Sure there will be losses along the way, how you handle them will make the difference between becoming financially free or stuck in a 9-5 job you don't like for life.

4. Be Well Informed

You don't create wealth by coincidence it takes hard work and knowledge of the tax law and the rules that govern investments to make money. You need to be well informed on how to protect your money and you have to keep finding ways to multiply it. Get in the habit of reading and reaching out to experts to stay informed. Go to the bank and ask about mortgage rates, credit cards and interest rates. Don't place all your trust on others they mostly serve as supplemental instructors most of the hard work will need to be done by you.

5. Be Strategic

As a financially literate person you must think of money making opportunities at all times. During the 2008 recession when people were losing their homes, as tough as it was for the masses it was also the best time to get in on stocks and commodities as well as real estate. Once you get the experience and confidence that financial literacy brings set out to make your own path. You don't acquire wealth by being a sweetheart and letting others decide what is best for you.

Pages

Sunday, December 30, 2012

Tuesday, December 25, 2012

Holiday Trading

The end of the year usually brings us joy, laughter and good times. For the most part trading slows down this time a year, sure there are strategic moves that can be made as well as those who believe in the January Effect. Although retirement accounts that are tax sheltered may reduce the need to sell to get a tax credit, uncertainty with dividend tax rates may bring last minute selling. In the article written by Jay Kaeppel his chart reveals the cumulative % gains from buying the Dow on the 3 days before and 3 days after a major holiday. A major holiday includes the 9 holidays in which the NYSE is closed 2 being Christmas and New Year's Day. Overall trading during the holidays looks pretty attractive and profitable. Enter December 2012 had you bought the Dow (DJI) on the 20th of December you would have experienced a slight gain followed by two days of drops but of course there are still another 4 days to go which inter lap with the New Year's Day trading period. If the opening bell tomorrow brings gains then buying on the 21st/22nd would have been a good idea.

Let's get realistic we are not talking about the usual Christmas Day trading session here, we are near the edge of a fiscal cliff. When the fate of the stock market rides on a major decision that could take us back to a recession one has to consider if staying out of the market's way is best. Investing during the fiscal cliff fiasco is the equivalent of rolling a pair of loaded dice as you don't know what you are going to get "Grand Bargain Shrinks as Congress Nearing U.S. Budget Deadline" and you don't want your money to be on the wrong side of that bet.

Then there are those investors that consider the (^VIX) to be a market indicator. On Friday the VIX hit 19 for the first time in December, the index indicates fear it likes to rise as the market falls. When comparing the VIX, Dow and the S&P 500 (^GSPC) the link shows how the VIX tends to be lower when the market is rising and it creeps upward when the market is dropping. There are times when the market and the VIX do not prove to be as reliable, during 2007 the S&P was making new all time highs yet the VIX did not make new all time lows. If you are young and planning to buy for the long term buy stocks with out panicking. If you are not a high income earner including baby boomers buy yourself the high yielding stock (JE) for the holidays and hold onto it ... go ahead why don't you?

Stock futures are currently in the red, Obama is in Hawaii with his family spending Christmas and the little drummer boy beats his drum so the beat goes on da da dum da dum ...

Sunday, December 16, 2012

Staying Positive During Hard Times

Despite the bad news like high unemployment rates for young adults, european recession, troubled economy, uncertainty with the tax system, troubled healthcare system and slow housing market recovery not all these roads lead to failure. What better time to start a business and contribute to the economy by adding jobs. When starting a new business consider that technology is the second most common way American billionaires have created their wealth. Pursue another career as long as this new passion is an employable one and a good return on investment. At some point in your career you may be able to combine both degrees and help out others or contribute to academia.

Whether day trading losses, real estate crashes or business failures the medicine is the same; stay positive and allow yourself to recover. According to Barbara Fredrickson a professor of psychology at the University of North Carolina "positive emotions help speed recovery from negative emotions" the negative emotions block the brain's ability to think outside the box and the ability to be creative. As professor Fredrickson states "losses loom larger than gains" "our mind is drawn into this mental time travel, and we're obsessing about something negative that happened in the past or we're worrying what will happen in the future." In her studies test subjects with high levels of anxiety were able to lower their blood pressure by viewing relaxing imagery. The moral of the story is to stay positive, take risk and recover from failure by having hope and showing gratitude.

Whether day trading losses, real estate crashes or business failures the medicine is the same; stay positive and allow yourself to recover. According to Barbara Fredrickson a professor of psychology at the University of North Carolina "positive emotions help speed recovery from negative emotions" the negative emotions block the brain's ability to think outside the box and the ability to be creative. As professor Fredrickson states "losses loom larger than gains" "our mind is drawn into this mental time travel, and we're obsessing about something negative that happened in the past or we're worrying what will happen in the future." In her studies test subjects with high levels of anxiety were able to lower their blood pressure by viewing relaxing imagery. The moral of the story is to stay positive, take risk and recover from failure by having hope and showing gratitude.

Sunday, November 25, 2012

Infant Mortality Rates In The U.S.

A country's infant mortality rate is a powerful indicator, the death of an infant has a bigger impact on the overall population's life expectancy than does a death from disease later on in life. The lowest infant mortality rates in 2012 can be found in Monaco, Japan, Bermuda, Singapore and Sweden. In Monaco the country averages just 1.80 deaths per 1000 live births, 2.04 male deaths and 1.55 female deaths per 1000 live births. The U.S. does not make the top 50, the country averages 6 deaths per 1000 live births, 6.6 male deaths and 5.3 female deaths per 1000 live births. The European Union averages 4.49 deaths per 1000 live births.

According to 2012 estimates the life expectancy for someone born in the U.S. according to the CIA World Factbook is 78.49 years. This number summarizes the mortality at all ages and the overall quality of life in a country. These numbers reflect the ROI in human capital and are used by actuaries. The U.S. comes in at number 51 and Monaco which not only has the lowest infant mortality rate also has the highest life expectancy rate with a life expectancy of 89.68 years. The average man in Monaco can expect to live 85.74 years and a woman can expect to live 93.77 years. The average man in the U.S. can expect to live 76.05 years and the average woman can expect to live 81.05 years. For some women marrying a younger man may not be such a bad idea after all. The European Union in 2010 averaged an overall life expectancy of 79.76 years.

Although the U.S does not make it to the top 10 of any list mentioned above the country spends an enormous amount of money in health expenditures. In 2009 the U.S. spent more than 16.20% of the nations total GDP on health expenditures. Monaco only spends about 4.3% of the countries GDP on health expenditures according to a World Bank report published in 2012. According to the World Bank the U.S. GDP was worth $15094.00 billion in 2011 about 24.35% of the world economy. While it is true that the U.S. population dwarfs that of Monaco the U.S. underperforms compared to other countries with a population greater than 10 million. There are other factors to consider. In the U.S. the number one cause of infant mortality is congenital malformations which accounts for about 20-25% of perinatal deaths. According to Doctor Teresa Marino a professor and attending physician at the Division of Maternal-Fetal Medicine at Tufts Medical Center many genetic disorders can be detected early in pregnancy using various noninvasive and invasive techniques. Examples of the noninvasive techniques are ultrasounds and MRIs.

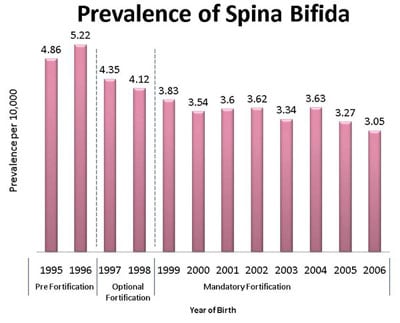

Lack of education can contribute to the higher mortality rates in the U.S. women need to be informed on how to take care of themselves during the pregnancy period. According to the Center for Disease Control and Prevention (CDC) a significant cause of infant mortality are neural tube defects not only in the U.S. but worldwide. Neural tube defects are birth defects of the brain and spine one of the most common being spina bifida. Something as easy as informing pregnant women to consume 400 mcg of folic acid daily can prevent neural tube defects. In the U.S. every year 3000 pregnancies are affected by these neural tube defects.

According to 2012 estimates the life expectancy for someone born in the U.S. according to the CIA World Factbook is 78.49 years. This number summarizes the mortality at all ages and the overall quality of life in a country. These numbers reflect the ROI in human capital and are used by actuaries. The U.S. comes in at number 51 and Monaco which not only has the lowest infant mortality rate also has the highest life expectancy rate with a life expectancy of 89.68 years. The average man in Monaco can expect to live 85.74 years and a woman can expect to live 93.77 years. The average man in the U.S. can expect to live 76.05 years and the average woman can expect to live 81.05 years. For some women marrying a younger man may not be such a bad idea after all. The European Union in 2010 averaged an overall life expectancy of 79.76 years.

Although the U.S does not make it to the top 10 of any list mentioned above the country spends an enormous amount of money in health expenditures. In 2009 the U.S. spent more than 16.20% of the nations total GDP on health expenditures. Monaco only spends about 4.3% of the countries GDP on health expenditures according to a World Bank report published in 2012. According to the World Bank the U.S. GDP was worth $15094.00 billion in 2011 about 24.35% of the world economy. While it is true that the U.S. population dwarfs that of Monaco the U.S. underperforms compared to other countries with a population greater than 10 million. There are other factors to consider. In the U.S. the number one cause of infant mortality is congenital malformations which accounts for about 20-25% of perinatal deaths. According to Doctor Teresa Marino a professor and attending physician at the Division of Maternal-Fetal Medicine at Tufts Medical Center many genetic disorders can be detected early in pregnancy using various noninvasive and invasive techniques. Examples of the noninvasive techniques are ultrasounds and MRIs.

Lack of education can contribute to the higher mortality rates in the U.S. women need to be informed on how to take care of themselves during the pregnancy period. According to the Center for Disease Control and Prevention (CDC) a significant cause of infant mortality are neural tube defects not only in the U.S. but worldwide. Neural tube defects are birth defects of the brain and spine one of the most common being spina bifida. Something as easy as informing pregnant women to consume 400 mcg of folic acid daily can prevent neural tube defects. In the U.S. every year 3000 pregnancies are affected by these neural tube defects.

Sunday, November 18, 2012

Investing in 2013

Where will we be in 2013, will the U.S. reach a compromise on spending and taxes?

Whether or not we enter January 1st with a deal investors have to prepare for any economic situation. For the past few years in a near zero interest rate country dividend stocks were the best alternative. Starting next year dividend income could be taxed as ordinary income, for high income earners that could be as high as 43%. All of a sudden dividends may not be as attractive as they once were for some, for baby boomers dividend paying stocks still are one of the best alternatives keeping some of the gain is better than keeping none.

Other issues to consider are the impact other countries will have on the global economy. Europe is not getting out of recession nor fixing their economic woes any time soon. Japan is also in deep debt and is a reminder of what can happen in a lost decade and beyond as a result of an asset bubble. Even if the possibility of the U.S. entering a recession as early as the first quarter of 2013 is small, investors may continue to react quickly and aggressively by dumping equities. Whether or not a tax hike and government spending cuts are necessary this could take the U.S. back into a recession. Cuts on Medicare alone would cut jobs and cause havoc for the elderly who are already having a tough time stretching out their retirement nest.

This market is about survival of the fittest old and young are having to invest with about the same amount of risk to make up for low interest rates. The young are cutting pennies and eating out less as if they were in their golden years, elders are having to go back to work for lower salaries as if they were millennials. In either case stocks are still the better alternative for the long run even if tax hikes are eminent. Investors can hold on to their stocks for the long run and sell when tax rates become more favorable. As the Fed continues to purchase bonds inflation is also a concern. This can be hedged through stocks but if the situation gets out of hand real estate is an option that has to be considered. During inflation and currency devaluation a piece of real estate can be a good hedge, it is an asset that can be lived in or rented out while the uncertainty and inflationary period goes on. In difficult economic times and while the tax law is not clear diversification is the best alternative. Leaving some money in cash is also a good financial move to wait and see where it should be allocated. If inflation starts accelerating investors do not want to be mostly in cash that is why being 100% in cash is not a good idea for anyone.

Is a bear market creeping nearby for the U.S. or is this a good buying opportunity?

If there is a deal that extends our current tax rates in our stockings this year this could send all three indexes up by more than 5%.

Whether or not we enter January 1st with a deal investors have to prepare for any economic situation. For the past few years in a near zero interest rate country dividend stocks were the best alternative. Starting next year dividend income could be taxed as ordinary income, for high income earners that could be as high as 43%. All of a sudden dividends may not be as attractive as they once were for some, for baby boomers dividend paying stocks still are one of the best alternatives keeping some of the gain is better than keeping none.

Other issues to consider are the impact other countries will have on the global economy. Europe is not getting out of recession nor fixing their economic woes any time soon. Japan is also in deep debt and is a reminder of what can happen in a lost decade and beyond as a result of an asset bubble. Even if the possibility of the U.S. entering a recession as early as the first quarter of 2013 is small, investors may continue to react quickly and aggressively by dumping equities. Whether or not a tax hike and government spending cuts are necessary this could take the U.S. back into a recession. Cuts on Medicare alone would cut jobs and cause havoc for the elderly who are already having a tough time stretching out their retirement nest.

This market is about survival of the fittest old and young are having to invest with about the same amount of risk to make up for low interest rates. The young are cutting pennies and eating out less as if they were in their golden years, elders are having to go back to work for lower salaries as if they were millennials. In either case stocks are still the better alternative for the long run even if tax hikes are eminent. Investors can hold on to their stocks for the long run and sell when tax rates become more favorable. As the Fed continues to purchase bonds inflation is also a concern. This can be hedged through stocks but if the situation gets out of hand real estate is an option that has to be considered. During inflation and currency devaluation a piece of real estate can be a good hedge, it is an asset that can be lived in or rented out while the uncertainty and inflationary period goes on. In difficult economic times and while the tax law is not clear diversification is the best alternative. Leaving some money in cash is also a good financial move to wait and see where it should be allocated. If inflation starts accelerating investors do not want to be mostly in cash that is why being 100% in cash is not a good idea for anyone.

Is a bear market creeping nearby for the U.S. or is this a good buying opportunity?

If there is a deal that extends our current tax rates in our stockings this year this could send all three indexes up by more than 5%.

Thursday, November 1, 2012

Obesity In The U.S.

Obesity has become a big problem in America not only does it add a huge cost to the already troubled health care system but it most importantly puts people at a higher risk for heart disease and stroke. Pinpointing the major factor that has led to the ascent of weight in the U.S. population is debatable but we can get an idea as to why: lack of exercise, lack of education, bigger food portions, technology, anxiety and unemployment. Having a sedentary lifestyle in a world ruled by computers and fast food spells disaster to one's health. We live in an environment where all our major life activities can be done from home with little if any physical activity. We can work from home, pay bills and do banking, get entertainment (Netflix, Youtube), eat (Domino's, Fresh Direct), socialize (FB, Skype, Text) and shop with very little physical activity.

According to the Center for Disease Control obesity has increased in every state according to their Overweight and Obesity Data. In 2011 Colorado had the lowest percentage of obesity cases 20.7% and Mississippi had the highest 34.9%. There are ways to help us with the fight against the pounds supplements that suppress appetite and shakes that fill us with protein, their efficiency debatable, if the obesity gets out of hand then bariatric surgery is the alternative. The FDA has not approved a drug treatment for obesity in 10 years until now Qysmia from Vivus (VVUS) and Belviq from Arena Pharmaceuticals (ARNA). Vivus is trying to get approval for the drug to be carried in retail pharmacies so far it has beat Belviq by being the first to reach the market through mail order pharmacies, in 2013 Belviq is expected to go on sale. Both stocks have seen their share of high volatility but Vivus has had quite the roller coaster ride its 52 week range 8.60 - 31.21 says it all. In September the stock was at 24 now it trades in the 14 point range the rise was in anticipation of sales the drop came after news that Europe would not recommend Qysmia due to concerns about safety.

Both drugs have their challenges ahead there is controversy in regards to which of the two drugs is more safe and which is more effective. As with pharmaceutical companies and their stock prices there are times when FDA approval sends the stock to the moon, then reality kicks in when sales come in lower than expected lassoing the stock back down from the clouds. We saw it happen with Human Genome Sciences and their treatment for lupus (Benlysta) investors that held on to the stock took the loss as HGSI is no longer listed GlaxoSmithKline (GSK) acquired them. Vivus is likely to miss the analyst forecast for sales in the fourth quarter based on the amount of prescriptions doctors have written so far according to IMS Health, it will report third quarter results on November 6th. In the midst of the battle of the two drugs another challenger emerges Orexigen Therapeutics (OREX) with its two candidates Contrave which has completed its phase III clinical trials and Empatic which has completed its phase II clinical trials. Both are combination drugs that treat obesity both drugs use Bupropion which acts on the weight control circuit by stimulating the POMC neuron it is believed to increase the level of dopamine activity in certain receptors in the brain and thus lower appetite. Mutations in the POMC gene have been associated with obesity and adrenal insufficiency. Contrave if approved can be a game changer in the fight against obesity since it addresses the reward system in the brain that causes food cravings.

According to the Center for Disease Control obesity has increased in every state according to their Overweight and Obesity Data. In 2011 Colorado had the lowest percentage of obesity cases 20.7% and Mississippi had the highest 34.9%. There are ways to help us with the fight against the pounds supplements that suppress appetite and shakes that fill us with protein, their efficiency debatable, if the obesity gets out of hand then bariatric surgery is the alternative. The FDA has not approved a drug treatment for obesity in 10 years until now Qysmia from Vivus (VVUS) and Belviq from Arena Pharmaceuticals (ARNA). Vivus is trying to get approval for the drug to be carried in retail pharmacies so far it has beat Belviq by being the first to reach the market through mail order pharmacies, in 2013 Belviq is expected to go on sale. Both stocks have seen their share of high volatility but Vivus has had quite the roller coaster ride its 52 week range 8.60 - 31.21 says it all. In September the stock was at 24 now it trades in the 14 point range the rise was in anticipation of sales the drop came after news that Europe would not recommend Qysmia due to concerns about safety.

Both drugs have their challenges ahead there is controversy in regards to which of the two drugs is more safe and which is more effective. As with pharmaceutical companies and their stock prices there are times when FDA approval sends the stock to the moon, then reality kicks in when sales come in lower than expected lassoing the stock back down from the clouds. We saw it happen with Human Genome Sciences and their treatment for lupus (Benlysta) investors that held on to the stock took the loss as HGSI is no longer listed GlaxoSmithKline (GSK) acquired them. Vivus is likely to miss the analyst forecast for sales in the fourth quarter based on the amount of prescriptions doctors have written so far according to IMS Health, it will report third quarter results on November 6th. In the midst of the battle of the two drugs another challenger emerges Orexigen Therapeutics (OREX) with its two candidates Contrave which has completed its phase III clinical trials and Empatic which has completed its phase II clinical trials. Both are combination drugs that treat obesity both drugs use Bupropion which acts on the weight control circuit by stimulating the POMC neuron it is believed to increase the level of dopamine activity in certain receptors in the brain and thus lower appetite. Mutations in the POMC gene have been associated with obesity and adrenal insufficiency. Contrave if approved can be a game changer in the fight against obesity since it addresses the reward system in the brain that causes food cravings.

Sunday, October 28, 2012

Europe's Situation Worsens

With Greece a few weeks away from running out of cash and with unemployment at 25.10% a deal must be reached soon to unleash more aid for the country. Greece is just one of many problems Europe is facing, for over a year the zone has been experiencing a rise in unemployment which is currently at 11.40%. Italy has seen its unemployment rate rise to 10.7% over the last year and Spain is struggling at 25.02%. Portugal has also experienced rising unemployment currently at 15% and Ireland's has also risen with rates at 14.8%. Poland has improved a bit yet its unemployment is at 12.4%, the U.K. and Germany have also shown some signs of improvement with rates below 8%.

The European scene has affected domestic companies in the U.S., Ford (F) has been feeling the heat, for the past 5 years car sales have fallen. Not hard to believe given that some European countries have seen their unemployment rates rise for the last 5 years straight. Ford plans to close down plants to handle the lack of demand one of them in Belgium. The European recession is strong and the debt crisis is no where nearly fixed, investors must be prepared for the repercussions and panic that this may continue to bring to markets.

The Nordic countries have also been affected by the European debt crisis but not as severe they have relatively low unemployment rates and are seen as safe havens in financial markets. Denmark's unemployment rates are at 4.7%, Norway has improved with rates at 3% and Sweden also has seen rates fall to 7.4%. According to Helge J. Pedersen, Nordea's Global Chief Economist "the Nordic countries emerge as clear winners of the economic beauty contest with the Euro area. However, even the Nordic countries are facing challenges in terms of sustainable growth years."

The European scene has affected domestic companies in the U.S., Ford (F) has been feeling the heat, for the past 5 years car sales have fallen. Not hard to believe given that some European countries have seen their unemployment rates rise for the last 5 years straight. Ford plans to close down plants to handle the lack of demand one of them in Belgium. The European recession is strong and the debt crisis is no where nearly fixed, investors must be prepared for the repercussions and panic that this may continue to bring to markets.

The Nordic countries have also been affected by the European debt crisis but not as severe they have relatively low unemployment rates and are seen as safe havens in financial markets. Denmark's unemployment rates are at 4.7%, Norway has improved with rates at 3% and Sweden also has seen rates fall to 7.4%. According to Helge J. Pedersen, Nordea's Global Chief Economist "the Nordic countries emerge as clear winners of the economic beauty contest with the Euro area. However, even the Nordic countries are facing challenges in terms of sustainable growth years."

Sunday, October 14, 2012

Market Outlook

A year has passed and the news continue to be the same despite this investors may start considering an entry point to either short stocks if they believe the market will drop or start buying if they believe the worst is behind. Slow global growth is expected to affect earnings from multinational companies and this will set the tone for the coming weeks as to where money should be allocated. Bonds are yielding 1.66%, CD's are below 1% and gold has been hovering in the high $1700's. It pretty much comes down to staying in cash or getting into stocks.

The European crisis is still a concern although it has been ignored for a while as the market (^DJI) climbed to $13,661.90 breaking a major point of resistance in September. Traders who had the chutzpah to short the market seeing it hit a 5 year high were rewarded quickly. There may be more downside in the coming days and a sell off which investors have been waiting for to get in. The fiscal cliff is a concern that can take the U.S. economy back into recession early next year if politicians do not make a deal that would evade the high tax hikes.

Some strategist have been recommending small cap companies on the Russell 2000 as they represent domestic companies and have more upside during the next few years despite global concerns. If traders believe that the economy will improve and that the market will not drop below 13000 they can start buying stock as soon as the release of corporate earnings when they will get a feel of the sentiment building up for stocks. Whichever way the market starts moving in the coming weeks getting in by increments if at all is the best way to go. A lot of people are still in cash for the time being, they are right to be weary specially when they have experienced large losses in a relatively short time period. Not all the latest news are bad the consumer sentiment report released last Friday shows a surge, consumer sentiment rose to 83.1. The jobless claims report last Thursday saw a 30k drop which is a big improvement but will still need to be confirmed by reports in the coming weeks. In the end it all comes down to timing risk correctly that's what separates the winners from the losers.

The European crisis is still a concern although it has been ignored for a while as the market (^DJI) climbed to $13,661.90 breaking a major point of resistance in September. Traders who had the chutzpah to short the market seeing it hit a 5 year high were rewarded quickly. There may be more downside in the coming days and a sell off which investors have been waiting for to get in. The fiscal cliff is a concern that can take the U.S. economy back into recession early next year if politicians do not make a deal that would evade the high tax hikes.

Some strategist have been recommending small cap companies on the Russell 2000 as they represent domestic companies and have more upside during the next few years despite global concerns. If traders believe that the economy will improve and that the market will not drop below 13000 they can start buying stock as soon as the release of corporate earnings when they will get a feel of the sentiment building up for stocks. Whichever way the market starts moving in the coming weeks getting in by increments if at all is the best way to go. A lot of people are still in cash for the time being, they are right to be weary specially when they have experienced large losses in a relatively short time period. Not all the latest news are bad the consumer sentiment report released last Friday shows a surge, consumer sentiment rose to 83.1. The jobless claims report last Thursday saw a 30k drop which is a big improvement but will still need to be confirmed by reports in the coming weeks. In the end it all comes down to timing risk correctly that's what separates the winners from the losers.

Sunday, September 30, 2012

The French Economy

According to The World Factbook France gets about 75 million foreign tourists per year making it the most visited country in the world. In 2011 France's GDP was worth 2772.03 billion in U.S. dollars according to the World Bank that is about 4.47% of the world economy. Currently the country's interest rate is the same as that of the euro zone 0.75% , the country's inflation rate was reported at 2.1% in August. Although closing lower at 1.2856 the euro has appreciated in value from July 2012 when it was trading at about 1.20.

Bordering between Spain and Italy, France appears to be going through some tough economic times of its own. The unemployment rate has increased from 7.4% in 2008 to 10.2% in the second quarter of 2012. France's lower than expected growth and high unemployment have increased borrowing costs and have cut government revenues. As a result the government budget deficit has risen steadily from 2008. During the last month French stocks have declined 58 points the CAC 40 closed at 3354.82, the top performer for the day was Publicis Groupe SA.

With a mild recession in France the country will cut the budget deficit ceiling by 3% by 2013. France's new president Francois Hollande is proposing to fix the country's economic problems while evading painful cuts, many believe the goal will not be met given the fact the country has very little growth if any. The government is looking to raise 30 billion euros through spending cuts and new taxes to meet the goal of lowering the budget deficit by 1.5%.

Bordering between Spain and Italy, France appears to be going through some tough economic times of its own. The unemployment rate has increased from 7.4% in 2008 to 10.2% in the second quarter of 2012. France's lower than expected growth and high unemployment have increased borrowing costs and have cut government revenues. As a result the government budget deficit has risen steadily from 2008. During the last month French stocks have declined 58 points the CAC 40 closed at 3354.82, the top performer for the day was Publicis Groupe SA.

With a mild recession in France the country will cut the budget deficit ceiling by 3% by 2013. France's new president Francois Hollande is proposing to fix the country's economic problems while evading painful cuts, many believe the goal will not be met given the fact the country has very little growth if any. The government is looking to raise 30 billion euros through spending cuts and new taxes to meet the goal of lowering the budget deficit by 1.5%.

Sunday, September 16, 2012

Investing For The Future

As recently announced by the Federal Reserve Quantitative Easing 3 has just been unleashed but unlike the first two this one has no announced end date. Some have already called it "QE3 Infinity" under QE3 the Fed will buy $40 billion every month in mortgage backed securities until the economy improves. This brings us to unknown territory one can only measure it with the symbol QE3אo (aleph-null) when predicting how to invest and guard ones money in this unique environment. At one point or another inflation has to be a concern to investors, the pumping of cash has to deteriorate the power of the U.S. dollar, with stocks indexes hitting 4 year highs the market has to be looked at with caution. Moving forward CD's and Treasuries are out of the question leaving few options for the serious investor. One option is buying dividend yielding stocks but in a market that is near 4yr highs purchasing now is a mistake therefore waiting to enter is a better strategy. The other option is real estate which seems ready for the taking for those investors that can afford to enter.

For investors with less cash 401k's and dollar cost averaging may be the way to go to evade heart breaks in the market, right now is not the time to put the farm in the stock market. QE3 is also a catalyst for commodities but unless an investor already owns gold buying the physical stuff right now is not too good a strategy, selling it or holding on to it a bit longer would be the better alternative. If inflation does pick up like in the early 1980's then precious metals or even base metals would be a better option than U.S. currency. The FOMC Meeting Announcement also stated interest rates will remain low 0-0.25% at least through mid 2015.

Inflation rates are currently at 1.7% the 10yr T-Note is trading at 1.87% yield barely enough to keep up with inflation which will likely pick up in the time to come. An investor with $100,000 in 2007 when the Great Recession started would have had to grow her money to $111,000 in 2012 just to protect her purchasing power according to the Bureau of Labor Statistics CPI inflation calculator. That means within those years an investor should have roughly earned 11% interest just to protect her money from inflation, to make it grow she would have had to earn 12% interest or higher. It is worth mentioning throughout that period 2009 saw inflation in the negative territory or deflation. Baby boomers must have anticipated this and that is why after the 2008 crash/nightmare they moved into low yielding CD's. Although boomers protected their money in 2009 they missed out on the opportunity of a lifetime to buy stocks at the bottom of the crash as a risk taker I started loading up in early 2009.

Before the recession hit, interest rates by the Federal Open Market Committee were 5.25% in early 2007 and ended the year at 4.25%. In 2008 at the height of the recession interest rates dropped to 0.25% which have stayed that way ever since. Beating inflation in a low interest rate environment is hard and with inflation likely to pick up it will be even harder. Stocks are one of the few choices out there the blue chips seem to be an investors best bet. In the short term inflation seems harmless especially at rates such as 1.7% but if an investor in 1995 would have left his $100,000 in the bank bearing no interest he would have lost half of the value of his money today. Over the years getting returns above inflation is the only way to create and preserve wealth. QE3 is a bullish move and stocks are the way to go yet investing wisely and through timed intervals is the only way to minimize risk.

For investors with less cash 401k's and dollar cost averaging may be the way to go to evade heart breaks in the market, right now is not the time to put the farm in the stock market. QE3 is also a catalyst for commodities but unless an investor already owns gold buying the physical stuff right now is not too good a strategy, selling it or holding on to it a bit longer would be the better alternative. If inflation does pick up like in the early 1980's then precious metals or even base metals would be a better option than U.S. currency. The FOMC Meeting Announcement also stated interest rates will remain low 0-0.25% at least through mid 2015.

Inflation rates are currently at 1.7% the 10yr T-Note is trading at 1.87% yield barely enough to keep up with inflation which will likely pick up in the time to come. An investor with $100,000 in 2007 when the Great Recession started would have had to grow her money to $111,000 in 2012 just to protect her purchasing power according to the Bureau of Labor Statistics CPI inflation calculator. That means within those years an investor should have roughly earned 11% interest just to protect her money from inflation, to make it grow she would have had to earn 12% interest or higher. It is worth mentioning throughout that period 2009 saw inflation in the negative territory or deflation. Baby boomers must have anticipated this and that is why after the 2008 crash/nightmare they moved into low yielding CD's. Although boomers protected their money in 2009 they missed out on the opportunity of a lifetime to buy stocks at the bottom of the crash as a risk taker I started loading up in early 2009.

Before the recession hit, interest rates by the Federal Open Market Committee were 5.25% in early 2007 and ended the year at 4.25%. In 2008 at the height of the recession interest rates dropped to 0.25% which have stayed that way ever since. Beating inflation in a low interest rate environment is hard and with inflation likely to pick up it will be even harder. Stocks are one of the few choices out there the blue chips seem to be an investors best bet. In the short term inflation seems harmless especially at rates such as 1.7% but if an investor in 1995 would have left his $100,000 in the bank bearing no interest he would have lost half of the value of his money today. Over the years getting returns above inflation is the only way to create and preserve wealth. QE3 is a bullish move and stocks are the way to go yet investing wisely and through timed intervals is the only way to minimize risk.

Table of Inflation Rates by Month and Year (1999-2012)

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Ave |

| 2012 | 2.9 | 2.9 | 2.7 | 2.3 | 1.7 | 1.7 | 1.4 | 1.7 | |||||

| 2011 | 1.6 | 2.1 | 2.7 | 3.2 | 3.6 | 3.6 | 3.6 | 3.8 | 3.9 | 3.5 | 3.4 | 3.0 | 3.2 |

| 2010 | 2.6 | 2.1 | 2.3 | 2.2 | 2.0 | 1.1 | 1.2 | 1.1 | 1.1 | 1.2 | 1.1 | 1.5 | 1.6 |

| 2009 | 0 | 0.2 | -0.4 | -0.7 | -1.3 | -1.4 | -2.1 | -1.5 | -1.3 | -0.2 | 1.8 | 2.7 | -0.4 |

| 2008 | 4.3 | 4 | 4 | 3.9 | 4.2 | 5.0 | 5.6 | 5.4 | 4.9 | 3.7 | 1.1 | 0.1 | 3.8 |

| 2007 | 2.1 | 2.4 | 2.8 | 2.6 | 2.7 | 2.7 | 2.4 | 2 | 2.8 | 3.5 | 4.3 | 4.1 | 2.8 |

| 2006 | 4 | 3.6 | 3.4 | 3.5 | 4.2 | 4.3 | 4.1 | 3.8 | 2.1 | 1.3 | 2 | 2.5 | 3.2 |

| 2005 | 3 | 3 | 3.1 | 3.5 | 2.8 | 2.5 | 3.2 | 3.6 | 4.7 | 4.3 | 3.5 | 3.4 | 3.4 |

| 2004 | 1.9 | 1.7 | 1.7 | 2.3 | 3.1 | 3.3 | 3 | 2.7 | 2.5 | 3.2 | 3.5 | 3.3 | 2.7 |

| 2003 | 2.6 | 3 | 3 | 2.2 | 2.1 | 2.1 | 2.1 | 2.2 | 2.3 | 2 | 1.8 | 1.9 | 2.3 |

| 2002 | 1.1 | 1.1 | 1.5 | 1.6 | 1.2 | 1.1 | 1.5 | 1.8 | 1.5 | 2 | 2.2 | 2.4 | 1.6 |

| 2001 | 3.7 | 3.5 | 2.9 | 3.3 | 3.6 | 3.2 | 2.7 | 2.7 | 2.6 | 2.1 | 1.9 | 1.6 | 2.8 |

| 2000 | 2.7 | 3.2 | 3.8 | 3.1 | 3.2 | 3.7 | 3.7 | 3.4 | 3.5 | 3.4 | 3.4 | 3.4 | 3.4 |

| 1999 | 1.7 | 1.6 | 1.7 | 2.3 | 2.1 | 2 | 2.1 | 2.3 | 2.6 | 2.6 | 2.6 | 2.7 | 2.2 |

Sunday, September 2, 2012

Investing Overseas

Heading into the worst month for stocks let us see if investing overseas had been a better alternative 2 and a half years ago when the market was still recovering.

March 2010 August 2012 Gain/Loss

Nikkei 225 - $10,645.79 $8839.91 (-$1805.88)

CAC 40 - $4013.97 $3413.07 (-$600.90)

DAX - $6048.30 $6970.79 (+$922.49)

Singapore (^STI) - $2894.55 $3025.46 (+$130.91)

Bovespa - $70,045 $57061.45 (-$12983.55)

Australia

All Ordinaries - $4889.80 $4339.02 (-$550.78)

FTSE 100 - $5500.30 $5,711.48 (+$211.18)

S&P/TSX

Composite - $11,866.90 $11,949.26 (+$82.36)

FTSE/MIB - $23,545.02 $15,100.48 (-$8444.54)

BSE 30 - $17558.73 $17,429.56 (-$129.17)

Mexico IPC - $32,758.53 $39,421.65 (+$6663.12)

Swiss Market - $6631.40 $6,388.01 (-$243.39)

FTSE/JSE Africa - $27,895.10 $35,389.45 (+$7494.35)

Hang Seng - $21,823.28 $19,482.57 (-$2340.71)

S&P 500 - $1132.99 $1,406.58 (+$273.59)

As the price table above shows investors would have been better off investing their money in the U.S. instead of trying to get profits overseas. Taking into consideration the transaction costs of buying international stocks most major indexes would have delivered small if any gains at all. In the last 2 years an investor most likely would have lost money or broken even overseas. Only Germany and 2 other countries would have brought gains taking into consideration the added risk of investing internationally. Perhaps a global mutual fund is a better alternative to international indexes if an investor feels confident and is knowledgeable hand picking individual international stocks can bring better returns as there are undervalued stocks in markets such as Russia.

For stocks September is the cruelest month therefore enter or exit positions with caution. September could bring QE3 yet the market may already have priced that in. This Thursday investors will be keeping an eye on the European Central Bank meeting and for the details on their purchase of Spanish and Italian debt. For this year the MSCI Emerging Markets Index has only gained about 3 percent. Entering a position in the Dow right now would be risky, as noted in my previous Benzinga article "Is Now A Good Time To Buy Stocks?" the Dow has faced major resistance in the 13k range and surely enough as I warned it came back down from 13300 to 12,978.91 and closed Friday at 13090. At this range an investor may be better off in the sideline waiting for technical signals. The S&P and Dow Jones have shown strong gains this year and taking a look abroad can be a good strategy for the rest of 2012.

March 2010 August 2012 Gain/Loss

Nikkei 225 - $10,645.79 $8839.91 (-$1805.88)

CAC 40 - $4013.97 $3413.07 (-$600.90)

DAX - $6048.30 $6970.79 (+$922.49)

Singapore (^STI) - $2894.55 $3025.46 (+$130.91)

Bovespa - $70,045 $57061.45 (-$12983.55)

Australia

All Ordinaries - $4889.80 $4339.02 (-$550.78)

FTSE 100 - $5500.30 $5,711.48 (+$211.18)

S&P/TSX

Composite - $11,866.90 $11,949.26 (+$82.36)

FTSE/MIB - $23,545.02 $15,100.48 (-$8444.54)

BSE 30 - $17558.73 $17,429.56 (-$129.17)

Mexico IPC - $32,758.53 $39,421.65 (+$6663.12)

Swiss Market - $6631.40 $6,388.01 (-$243.39)

FTSE/JSE Africa - $27,895.10 $35,389.45 (+$7494.35)

Hang Seng - $21,823.28 $19,482.57 (-$2340.71)

S&P 500 - $1132.99 $1,406.58 (+$273.59)

As the price table above shows investors would have been better off investing their money in the U.S. instead of trying to get profits overseas. Taking into consideration the transaction costs of buying international stocks most major indexes would have delivered small if any gains at all. In the last 2 years an investor most likely would have lost money or broken even overseas. Only Germany and 2 other countries would have brought gains taking into consideration the added risk of investing internationally. Perhaps a global mutual fund is a better alternative to international indexes if an investor feels confident and is knowledgeable hand picking individual international stocks can bring better returns as there are undervalued stocks in markets such as Russia.

For stocks September is the cruelest month therefore enter or exit positions with caution. September could bring QE3 yet the market may already have priced that in. This Thursday investors will be keeping an eye on the European Central Bank meeting and for the details on their purchase of Spanish and Italian debt. For this year the MSCI Emerging Markets Index has only gained about 3 percent. Entering a position in the Dow right now would be risky, as noted in my previous Benzinga article "Is Now A Good Time To Buy Stocks?" the Dow has faced major resistance in the 13k range and surely enough as I warned it came back down from 13300 to 12,978.91 and closed Friday at 13090. At this range an investor may be better off in the sideline waiting for technical signals. The S&P and Dow Jones have shown strong gains this year and taking a look abroad can be a good strategy for the rest of 2012.

Sunday, August 19, 2012

Is Now A Good Time To Buy Stocks?

The rally we have seen throughout August may continue into September but a correction may take place and that alone should be a warning sign. Investors that did not get into the market while the Dow Jones Industrial Average (^DJI) was in the 12000's best stay on the sideline to wait if the Dow can build some strong support in the 13k range. During the past year the Dow Jones has touched the 13000 mark three times in all three it has faced major resistance at 13300 and eventually returned to the 12k range. I would not recommend shorting the market just yet, if the Fed decides on more stimulus or not is a major market mover and you don't want to be on the wrong side of that bet.

The 10 Year T-Note (^TNX) at 1.82% doesn't seem too attractive even with inflation at 1.40%. Waiting appears to be the better alternative a stock dividend is currently the best financial instrument to preserve wealth. Although stocks are the best alternative the wealthy are getting tired of the uncertainty and the violent roller coaster rides that we have experienced through out the recession and the recovery phase. The wealthy are mostly staying in cash for the time being, they do not want to risk losing large chunks of wealth in a small time frame. The low volume the market has experienced is another sign of caution.

The global economy is not giving signs of strong improvement making investors more risk averse. Despite the economic weather global stock indexes have rallied. The Euro STOXX 50 rallied 234 points during the last 30 days closing at 2,471.53. The Shanghai Composite Index declined 54 points during the last month closing at 2,114.89. The NIKKEI 225 rallied 493 points in the last 30 days closing at 9,162.50. The DAX has rallied 411 points closing on Friday at 7,040.88. The CAC 40 stocks list on the Paris Bourse has rallied 294 points in the last 30 days closing at 3,488.38. The BOVESPA has rallied 4888 points in the last 30 days closing at 59,082.37. The FTSE 100 has rallied 201 points in the last 30 days closing at 5,852.42.

The 10 Year T-Note (^TNX) at 1.82% doesn't seem too attractive even with inflation at 1.40%. Waiting appears to be the better alternative a stock dividend is currently the best financial instrument to preserve wealth. Although stocks are the best alternative the wealthy are getting tired of the uncertainty and the violent roller coaster rides that we have experienced through out the recession and the recovery phase. The wealthy are mostly staying in cash for the time being, they do not want to risk losing large chunks of wealth in a small time frame. The low volume the market has experienced is another sign of caution.

The global economy is not giving signs of strong improvement making investors more risk averse. Despite the economic weather global stock indexes have rallied. The Euro STOXX 50 rallied 234 points during the last 30 days closing at 2,471.53. The Shanghai Composite Index declined 54 points during the last month closing at 2,114.89. The NIKKEI 225 rallied 493 points in the last 30 days closing at 9,162.50. The DAX has rallied 411 points closing on Friday at 7,040.88. The CAC 40 stocks list on the Paris Bourse has rallied 294 points in the last 30 days closing at 3,488.38. The BOVESPA has rallied 4888 points in the last 30 days closing at 59,082.37. The FTSE 100 has rallied 201 points in the last 30 days closing at 5,852.42.

Saturday, August 4, 2012

Investing In Ford

Fast forward to 2012 the company trades at $9.09 and is having trouble delivering solid numbers overseas. The Ford Focus has been a top seller with the U.S. market as well as abroad but the company has had a hard time selling the all electric Ford Focus which has seen very little demand. In the second quarter Ford reported a 57% profit drop due to losses in Europe and Asia. Ford predicts a strong operating profit despite the global slowdown although numbers will be lower than 2011. In Europe alone Ford expects a $1 billion loss. The automaker did beat Wall Street's forecast of 28 cents. Without one time items, including the sale of two parts factories, earning 30 cents. In North America Ford posted a $2 billion profit in the second quarter. In South America the company saw its sales dwindle some of the fault can be attributed to higher tariffs.

Earlier this year Ford started paying dividends at 2.20% yield the company has a P/E ratio of 2.07. General Motors currently trades at $20.04 with a P/E ratio of 7.16. Price-to-earnings ratios in the single digits tend to be seen as good buys by investors. Toyota Motor (TM) trades at $81.06 with a 1.20% dividend and a P/E ratio of 35.18. Some investors see P/E ratios of 35 as an indicator that a stock may be overpriced. In early summer 2010 Ford was trading at around $11 with a P/E ratio of about 9. After reaching $18 in January 2011 Ford's price has dropped significantly seeing some major resistance at $13 and currently trading in the $9-$10 range for over 3 months.

Ford and GM move in very similar direction that is to say that if an investor believes that Ford will go up in value so will GM and vice versa. Before the Great Recession one could make money by pair trading F and GM whose prices moved together. When the stock prices deviated an investor would short the winner and go long the loser as a form of arbitrage. I do not see that opportunity with Ford and GM any longer. Therefore I would not count on the two stocks following similar price patterns the same way they did in the past. Ford could drop significantly while GM rises giving no short term opportunity to cash in. Ford may continue to struggle a bit abroad and with the sales of electric cars, in the long run I believe Ford will grow and continue to be a true symbol of Americana. What can be more American than a Ford Mustang?

Saturday, July 28, 2012

Brazil's Economy

Brazil is the leading economic power in South America it has a vast workforce and natural resources such as gold and petroleum. Brazil is the largest country in South America in July its population was reported to be 205,716,890 according to the World Factbook. According to the World Bank Brazil's GDP was worth 2476.6 billion dollars in 2011 that makes up about 3.37% of the world economy. The Brazilian Real currently trades at 2.0221 per U.S. dollar, in the last 30 days the USD/BRL has depreciated about 2.8% in July 2011 the currency was trading at about 1.58.

In 2007-08 Brazil experienced strong growth and its debt was given investment grade status. It is no surprise that the 2008 global recession did not spare Brazil, it entered a recession due to a slow global demand for its commodities. Brazil came back strong and was one of the first markets to recover delivering a GDP growth rate of 7.5% in 2010. Rising inflation and the global economic slowdown in 2011 brought down Brazil's GDP growth rate to 2.7%, the first quarter of 2012 saw even lower growth. Brazil's inflation rate is currently 4.92% and interest rates reached a record low of 8% in July 2012. The country's high interest rates in a world of low interest rates make it attractive for investment. Brazil's 10yr government bond is yielding 12.55% interest. In 2011 Brazil became the world's seventh largest economy in terms of GDP making it an important player, the title was previously held by the United Kingdom. The unemployment rate was reported to be 5.8% in June 2012.

The Bovespa Brazil's Sao Paulo Stock Exchange Index has rallied 3900 points in the last 30 days. It closed at 56,553.12 on Friday one of the top performers for the day was OGX Petroleo e Gas Participacoes SA which is an oil and gas production company.

Although some investors have placed their faith in the Brazilian economy it has been slowing down a bit some of the fault can be pinned on a weaker demand for the country's goods. On Friday the President of the South American country Dilma Rousseff stated the government will look to stimulate the economy by investing more in infrastructure. Although the global economy is slowing she sees the economic growth in Brazil accelerating in the coming months. Economists believe the country's growth will remain below 2% for 2012.

In 2007-08 Brazil experienced strong growth and its debt was given investment grade status. It is no surprise that the 2008 global recession did not spare Brazil, it entered a recession due to a slow global demand for its commodities. Brazil came back strong and was one of the first markets to recover delivering a GDP growth rate of 7.5% in 2010. Rising inflation and the global economic slowdown in 2011 brought down Brazil's GDP growth rate to 2.7%, the first quarter of 2012 saw even lower growth. Brazil's inflation rate is currently 4.92% and interest rates reached a record low of 8% in July 2012. The country's high interest rates in a world of low interest rates make it attractive for investment. Brazil's 10yr government bond is yielding 12.55% interest. In 2011 Brazil became the world's seventh largest economy in terms of GDP making it an important player, the title was previously held by the United Kingdom. The unemployment rate was reported to be 5.8% in June 2012.

The Bovespa Brazil's Sao Paulo Stock Exchange Index has rallied 3900 points in the last 30 days. It closed at 56,553.12 on Friday one of the top performers for the day was OGX Petroleo e Gas Participacoes SA which is an oil and gas production company.

Although some investors have placed their faith in the Brazilian economy it has been slowing down a bit some of the fault can be pinned on a weaker demand for the country's goods. On Friday the President of the South American country Dilma Rousseff stated the government will look to stimulate the economy by investing more in infrastructure. Although the global economy is slowing she sees the economic growth in Brazil accelerating in the coming months. Economists believe the country's growth will remain below 2% for 2012.

Wednesday, July 18, 2012

Food Prices To Rise

Corn Futures prices have been trending upward these last few months but have picked up even more steam in June-July closing today at $7.8425 a bushel. Soybeans and Oats have also increased in price and closed higher today. The Midwest drought has cleaned out crops in fields and can be expected to cause food prices to increase later this year and into 2013. Oil prices have also spiked and if they continue this way they will only add to expensive food prices throughout the year. Some investors believe this will jump start inflation along with QE3 if it is injected this year or the following. During the early 1980's we had a double dip recession which was followed by some heavy inflation. Investors ran for their lives while they could and took refuge in real estate before their dollars could be eaten alive. Whether we endure heavy inflation or not we can still prepare ahead of time by keeping some money in liquid form and looking for other safe havens such as gold and stocks.

Tuesday, July 17, 2012

Taking Care Of Your Credit Card Debt

In this economic environment where interest rates are at 0.25% no one should have to pay 24.9% APR on credit card debt specially since interest rates will stay low until 2014. As a consumer and a financially responsible individual you should be concerned at the amount of debt you hold and at what rate you repay that loan. When reducing debt your first step should be to put your plan of repayment on a piece of paper so you will stick to it. Your second step should be to call your credit card company to negotiate a lower APR by stating that you want to pay off your debt quickly. If a credit card company has you at a high interest rate while you have good credit you should not be holding any debt on that card.

If you cannot get your current credit card company to lower rates shop around to see if you can strategically transfer your balance. Try not to apply for too many credit cards as this will lower your credit score. Even if you transfer the balance to only one credit card issuer this will result in a small drop on your credit score but it can be worth it if it frees up some of your credit, the small drop will disappear within 6 months. Remember the less available credit you use the higher your credit score will be.

If you have an outstanding balance of $10,000 at a current APR of 24% you should look to transfer that balance at a zero introductory rate for 15-18 months and a lower rate after the introductory rate expires. The national average APR on new card offers is currently 14.91%. Read the fine print, these offers might have ways of hurting those suffering from less than optimal credit scores. Credit card issuers can change the terms after the introductory rate has expired. Watch out for balance transfer fees they are usually 3% and they may not be capped. If you have excellent credit take advantage of the limited time offer some banks are promoting: zero balance transfer fees.

A credit card balance transfer should be used strategically and not often, this can hurt your credit score and it may affect the way lenders see you. It should be used to get rid of old debt at a lower rate and not to give you room to breathe as you continue to purchase recklessly. I would only recommend a balance transfer for those trying to eliminate debt within the introductory zero rate time frame and not to add any other purchases within that time period. Credit card issuers know that the odds are against the debt holder and that most likely they will continue to make purchases on this new card. They also know that the debt holder will have a hard time repaying their balance in full within the zero introductory time period. If you know you have a problem get free help and counseling before you consider transfer balances or consolidating.

If you cannot get your current credit card company to lower rates shop around to see if you can strategically transfer your balance. Try not to apply for too many credit cards as this will lower your credit score. Even if you transfer the balance to only one credit card issuer this will result in a small drop on your credit score but it can be worth it if it frees up some of your credit, the small drop will disappear within 6 months. Remember the less available credit you use the higher your credit score will be.

If you have an outstanding balance of $10,000 at a current APR of 24% you should look to transfer that balance at a zero introductory rate for 15-18 months and a lower rate after the introductory rate expires. The national average APR on new card offers is currently 14.91%. Read the fine print, these offers might have ways of hurting those suffering from less than optimal credit scores. Credit card issuers can change the terms after the introductory rate has expired. Watch out for balance transfer fees they are usually 3% and they may not be capped. If you have excellent credit take advantage of the limited time offer some banks are promoting: zero balance transfer fees.

A credit card balance transfer should be used strategically and not often, this can hurt your credit score and it may affect the way lenders see you. It should be used to get rid of old debt at a lower rate and not to give you room to breathe as you continue to purchase recklessly. I would only recommend a balance transfer for those trying to eliminate debt within the introductory zero rate time frame and not to add any other purchases within that time period. Credit card issuers know that the odds are against the debt holder and that most likely they will continue to make purchases on this new card. They also know that the debt holder will have a hard time repaying their balance in full within the zero introductory time period. If you know you have a problem get free help and counseling before you consider transfer balances or consolidating.

Thursday, July 12, 2012

It's OK To Stay On The Sideline For Now

The market sentiment has been weak these last few days. With that said traders should have taken profits or shorted the market during the end of June; I know I did. Since the Recession began the Dow has had a hard time hitting 13,000 and when it does it faces some tough resistance. Slow growth data from major players around the globe was a good hint to sell when the Dow came close to hitting the13,000 mark once again at the beginning of the month, it was surprising it got so close given the global economic state we are in.

Too many uncertainties and bad news are reason enough for investors to take a moment to plan their next move. Taking a look from the outside gives an investor a relaxed point of view. Investors have to digest the possibility of another U.S. credit downgrade, double dip recession and possibly a lost decade. Some believe we never really came out of the recession. Most of Europe is sporting interest rates below 2.00% and other major countries have been cutting their rates. It appears they are preparing for a tough financial environment. Investors may just watch what the market will do next in terms of U.S. data and stimulus as well as the presidential elections. If the market drops it may be a good opportunity to start picking up high dividend yielding stocks - interest rates are so low it has become hard to get decent returns. With 10 yr treasuries (^TNX) yielding 1.48 an investor is better off in cash waiting to get in on a good stock.

Entering or exiting the market at the right time is essential for profit making. The market may seem cheap to some investors out there but given the data and the way the world is positioned I would reconsider. The market can move violently on fear, the official announcement of a U.S. double dip recession won't be pretty people have had it with daily news about the euro crisis and the high unemployment in the U.S. it has been 5 years since the recession started and 3 years since it ended.

Real estate has not been improving at a quick enough pace, for the 1st quarter of 2012 property sales were showing signs of either no improvement or very slow progress. According to Jones Lang LaSalle 2012 review "Vacancy levels continue to drop nationally in trophy and Class A properties in 2011; yet, with the exception of markets spurred by technology, energy and healthcare demands, they have a way to go before witnessing the lows of 2006," said John Sikaitis, Director of U.S. Office Research.

An investor should not be entering trades in haste, cash is good right now if anything the dollar is worth more now with currencies depreciating to the almighty dollar. On the other hand a strong dollar can hurt U.S. companies, waiting for earnings reports to give us a clearer picture is a good way to sit it out until the environment gets a little more safe to take positions. The market seems to be signaling more news on the bearish side at any moment we could get a summer crash just like 2011 and as it is said it is best to buy stock when there is still blood on the street. I don't feel that confident buying just yet as the global data could send us into a bear market even after another round of stimulus. The Fed did not state it will implement Q3. But as Nouriel Roubini states in his Bloomberg TV interview the Fed may already be out of effective cures to aid our hurting economy.

At this point it is about strategically entering the market and analyzing world data to get a good buy or sell. Although most data signals trouble not all the news out is bad, initial claims for state unemployment benefits in the United States have dropped to a four year low.

Too many uncertainties and bad news are reason enough for investors to take a moment to plan their next move. Taking a look from the outside gives an investor a relaxed point of view. Investors have to digest the possibility of another U.S. credit downgrade, double dip recession and possibly a lost decade. Some believe we never really came out of the recession. Most of Europe is sporting interest rates below 2.00% and other major countries have been cutting their rates. It appears they are preparing for a tough financial environment. Investors may just watch what the market will do next in terms of U.S. data and stimulus as well as the presidential elections. If the market drops it may be a good opportunity to start picking up high dividend yielding stocks - interest rates are so low it has become hard to get decent returns. With 10 yr treasuries (^TNX) yielding 1.48 an investor is better off in cash waiting to get in on a good stock.

Entering or exiting the market at the right time is essential for profit making. The market may seem cheap to some investors out there but given the data and the way the world is positioned I would reconsider. The market can move violently on fear, the official announcement of a U.S. double dip recession won't be pretty people have had it with daily news about the euro crisis and the high unemployment in the U.S. it has been 5 years since the recession started and 3 years since it ended.

Real estate has not been improving at a quick enough pace, for the 1st quarter of 2012 property sales were showing signs of either no improvement or very slow progress. According to Jones Lang LaSalle 2012 review "Vacancy levels continue to drop nationally in trophy and Class A properties in 2011; yet, with the exception of markets spurred by technology, energy and healthcare demands, they have a way to go before witnessing the lows of 2006," said John Sikaitis, Director of U.S. Office Research.

An investor should not be entering trades in haste, cash is good right now if anything the dollar is worth more now with currencies depreciating to the almighty dollar. On the other hand a strong dollar can hurt U.S. companies, waiting for earnings reports to give us a clearer picture is a good way to sit it out until the environment gets a little more safe to take positions. The market seems to be signaling more news on the bearish side at any moment we could get a summer crash just like 2011 and as it is said it is best to buy stock when there is still blood on the street. I don't feel that confident buying just yet as the global data could send us into a bear market even after another round of stimulus. The Fed did not state it will implement Q3. But as Nouriel Roubini states in his Bloomberg TV interview the Fed may already be out of effective cures to aid our hurting economy.

At this point it is about strategically entering the market and analyzing world data to get a good buy or sell. Although most data signals trouble not all the news out is bad, initial claims for state unemployment benefits in the United States have dropped to a four year low.

Wednesday, July 4, 2012

How Healthy Is The Indian Economy Today?

As traders wait on the Fed to add more stimulus to the U.S. economy it is important to see how the rest of the world is performing. From recent data on manufacturing it is obvious that growth has been slowing down worldwide. Despite the rally we have seen the last few days on the hope of stimulus the fact of the matter is the world is hurting, global risk has reached Asia with lower orders from the rest of the world. In 2010 India recovered from the global recession due to their growth exceeding 8% year after year. Since 1997 India has been growing above 7% according to the World Factbook. According to a report by the World Bank India's GDP was worth 1729.01 billion dollars in 2010 or 2.79% of the world economy.

In 2011 India's economic growth started to slow the rupee has depreciated close to 25% over the past year currently trading at 54.53 USD/INR. Despite the crisis in the euro zone the rupee has also slipped against the euro about 10% in the past year currently trading at 68.32 EUR/INR. In the first quarter of 2012 India's GDP growth rate expanded 5.3%. Let us not forget the high inflation rate in the country inching its way up to 7.55% in May and interest rates hovering at 8% make for a troubling economy. India still faces widespread poverty and inadequate access to higher education although they do have a large English speaking population who are major exporters of information technology services. Non agricultural jobs are still a concern in the Asian country their unemployment rate stands at 9.40%.

The SENSEX 30 a major stock market index in India closed at 17,462.81 it has rallied 1461 points in the last month. One of the top performers for the day was Sterlite Industries India Ltd which manufactures electrical wires as well as zinc and lead products. You can find Mukesh Ambani as one of the 38 Indian billionaires on Forbes he makes the list at number 19 compared to other world billionaires, he is the richest man in India.

It seems the Indian boom that lasted for more than a decade is coming to a halt and some worry about a lost decade. Morgan Stanley has lowered its forecast for India's economic growth for 2012 and 2013.

In 2011 India's economic growth started to slow the rupee has depreciated close to 25% over the past year currently trading at 54.53 USD/INR. Despite the crisis in the euro zone the rupee has also slipped against the euro about 10% in the past year currently trading at 68.32 EUR/INR. In the first quarter of 2012 India's GDP growth rate expanded 5.3%. Let us not forget the high inflation rate in the country inching its way up to 7.55% in May and interest rates hovering at 8% make for a troubling economy. India still faces widespread poverty and inadequate access to higher education although they do have a large English speaking population who are major exporters of information technology services. Non agricultural jobs are still a concern in the Asian country their unemployment rate stands at 9.40%.

The SENSEX 30 a major stock market index in India closed at 17,462.81 it has rallied 1461 points in the last month. One of the top performers for the day was Sterlite Industries India Ltd which manufactures electrical wires as well as zinc and lead products. You can find Mukesh Ambani as one of the 38 Indian billionaires on Forbes he makes the list at number 19 compared to other world billionaires, he is the richest man in India.

It seems the Indian boom that lasted for more than a decade is coming to a halt and some worry about a lost decade. Morgan Stanley has lowered its forecast for India's economic growth for 2012 and 2013.

Thursday, June 28, 2012

What Investors Need To Know About Japan

In the 90's Japan experienced a slowdown in their economy known as the "Lost Decade" despite the aftershock Japan is still a major economic power. Japan's GDP was worth 5497.81 billion in 2010 according to the World Bank. In 2011 Japan stood as the 4th largest economy in the world according to the World Factbook.

The country's energy infrastructure and economy were hurt in March 2011 as a result of the 9.0 magnitude earthquake, the strongest it has ever had. This is devastating since the country has no natural energy resources, Japan is the 2nd largest importer of oil and the largest importer of coal and liquefied natural gas. Japan was another victim the Great Recession claimed it experienced a slowdown for its exports and caused the country to slip further into recession. Stimulus spending allowed the country to recover in 2009-10 but the earthquake and tsunami in 2011 delivered a strong blow which disrupted their economy once again.

The Nikkei 225 closed higher today at 8874.11 one of the day's top performers was Yamaha Corp. Japan is among the world's most technologically advanced and largest producers of motor vehicles.

According to Forbes Tadashi Yanai & Family is #88 on the list of billionaires he is the founder of Fast Retailing of which Uniqlo is a subsidiary. The company opened up a Uniqlo store in Manhattan becoming the single largest retail space on Fifth Avenue.

Japan's consumer confidence has been improving after collapsing at 26.2 in December 2008 it is currently at 40.70. The unemployment rate in the country is 4.6%, inflation at 0.40% and interest rates are at 0%. Japan is considered a safe haven especially with the European crisis scaring the world, in June demand for their bonds hit a record high. Foreigners own about 8.3% of all Japanese government bonds even though the 10yr only yields .82%. A Japanese yield spike should worry us all, half of the government's revenue goes to paying interest on these bonds.

Japan faces other long term problems such as deflation, dependence on exports to generate growth and an aging population. With electricity supplies tight in Japan and manufacturing troubles the country is considering the idea of free trade with the European Union and other countries.

The country's energy infrastructure and economy were hurt in March 2011 as a result of the 9.0 magnitude earthquake, the strongest it has ever had. This is devastating since the country has no natural energy resources, Japan is the 2nd largest importer of oil and the largest importer of coal and liquefied natural gas. Japan was another victim the Great Recession claimed it experienced a slowdown for its exports and caused the country to slip further into recession. Stimulus spending allowed the country to recover in 2009-10 but the earthquake and tsunami in 2011 delivered a strong blow which disrupted their economy once again.

The Nikkei 225 closed higher today at 8874.11 one of the day's top performers was Yamaha Corp. Japan is among the world's most technologically advanced and largest producers of motor vehicles.

According to Forbes Tadashi Yanai & Family is #88 on the list of billionaires he is the founder of Fast Retailing of which Uniqlo is a subsidiary. The company opened up a Uniqlo store in Manhattan becoming the single largest retail space on Fifth Avenue.