It is never too early or too late to start investing. It is easy to start you do not need to be wealthy to open an online account. Reputable online brokers require investors to start with a deposit ranging from $500-$2500 and they charge $7-$9.99 to buy or sell a stock. If you do not have much money treat it as a 401k and only add $100 every 2 weeks. For a beginner it is best to use dollar cost averaging especially with the market setting new highs. Even if you have the cash do not invest all your money at once.

Make sure you understand the risks and costs of trading. Pick stocks you are familiar with and companies that interest you. Understand that stocks are not all alike they do not move or feel the same. A stock with high beta (above 1) like Facebook (FB) will be very volatile it will change in price more than the Dow (DJI) or S&P 500 (GSPC) the opposite is true for Pfizer (PFE). Another way to tell how a stock will move in price is by the volume, a stock like (GE) with over 31 million shares will need a lot of buying from investors to make the price move in either direction. General Electric is not a good stock for a day trader but it is a good stock for a long term trader or swing trader. On the other hand a stock like Visa (V) with 3 million shares won't require much buying or selling for the stock's price to move making for some quick gains or losses.

When buying or selling stock a limit order is one of the safest ways to get a stock at the price you want. If you place a limit order to buy Merck (MRK) at $43.50 the order will not execute unless the stock reaches a price of $43.50 or less. When purchasing a security I recommend buying 100 shares minimum if you do not have the means then buy what you can. As a long term trader diversify and buy regularly only readjust occasionally to protect your portfolio.

Pages

Sunday, March 31, 2013

Sunday, March 17, 2013

How To Become A Millionaire

Does money make you happy? Whether it does or not one thing is certain money well used gives you freedom. Freedom to travel, study and help out your family. Becoming a millionaire is not that hard if you have determination and set goals on how to get there.

How to start?

Try to save as much as you can whether you work part time or full time. You can't work for every single dollar at some point you have to let your money work for you by earning interest. There is no excuse when it comes to creating wealth whether you earn a small amount of income or if you come from a wealthy family, complaining will only hold you back. Decide to be happy and that alone will make your journey easier and free up your mind to work on your money making ideas.

Study the real estate market even if you don't want to buy right now, a good investor knows what the economy is doing and keeps his options open. About 97% of the millionaires interviewed "The Millionaire Next Door" are homeowners and have occupied the same home for many years.

Study the economy and the stock market it is easy to start open up an account with an online brokerage firm with as little as $500. The wealthy invest regularly and take control of their investment decisions. To get an idea of what kind of returns it will take to become a millionaire try this online calculator. Take risk; there is no reward for being too safe in life.

Whether you are working a 9-5 or are a freelance worker think about earning income on the side by starting an online business. About two thirds of American millionaires are self employed.

Looks can be deceiving a good amount of millionaires in America are frugal they don't drive fancy cars they don't look the part. The digital era has changed the game. Gone are the days when gray hair meant wealth and top management. Look around who is creating the best technology and making the best use of it? You have 20yr olds becoming millionaires and billionaires in record time. The young are becoming CEOs of their new found companies and leaving their mark online.

There are joys to saving, investing and financially educating yourself one of which is having a "go to hell fund" this fund measures how long you can live comfortably without having to work. The wealthy live well below their means therefore they can go a very long time without working.

How to start?

Try to save as much as you can whether you work part time or full time. You can't work for every single dollar at some point you have to let your money work for you by earning interest. There is no excuse when it comes to creating wealth whether you earn a small amount of income or if you come from a wealthy family, complaining will only hold you back. Decide to be happy and that alone will make your journey easier and free up your mind to work on your money making ideas.

Study the real estate market even if you don't want to buy right now, a good investor knows what the economy is doing and keeps his options open. About 97% of the millionaires interviewed "The Millionaire Next Door" are homeowners and have occupied the same home for many years.

Study the economy and the stock market it is easy to start open up an account with an online brokerage firm with as little as $500. The wealthy invest regularly and take control of their investment decisions. To get an idea of what kind of returns it will take to become a millionaire try this online calculator. Take risk; there is no reward for being too safe in life.

Whether you are working a 9-5 or are a freelance worker think about earning income on the side by starting an online business. About two thirds of American millionaires are self employed.

Looks can be deceiving a good amount of millionaires in America are frugal they don't drive fancy cars they don't look the part. The digital era has changed the game. Gone are the days when gray hair meant wealth and top management. Look around who is creating the best technology and making the best use of it? You have 20yr olds becoming millionaires and billionaires in record time. The young are becoming CEOs of their new found companies and leaving their mark online.

There are joys to saving, investing and financially educating yourself one of which is having a "go to hell fund" this fund measures how long you can live comfortably without having to work. The wealthy live well below their means therefore they can go a very long time without working.

Tuesday, March 5, 2013

The Dow Breaks 14,200

The Dow Jones (^DJI) made a new all time high today reaching 14,286.37 during the intraday and closing at 14,253.77. The last record was set during October 2007 then the great recession hit and down came the Dow violently losing 50% in the following 15 months. Although the Dow set a new all time high today it would need to break 15,000 to beat the 2007 record taking inflation into consideration. Will the Dow go to 15,000 in the near term? The index is not likely to go uninterrupted to 15,000 it is more likely to get some corrective measures.

Let's see if the index can evade the "sell in May and go away" adage. Investors that were lucky enough to get in during the end of last year should be considering taking some profits if not most of them. While dividend stocks still seem favorable buying them now is not a good idea. Inflation has been dropping since last year and was reported at 1.6% for the month of January. While deflation may not be in the radar inflation has stayed fairly low during the past year making cash not that bad of an idea for the short term. Although the Dow set an all time high the Volatility Index (^VIX) has not made a new all time low. The VIX failed to make an all time low in October 2007 and then the S&P 500 (^GSPC) and Dow both came tumbling down. Will the same be true this time around?

Let's see if the index can evade the "sell in May and go away" adage. Investors that were lucky enough to get in during the end of last year should be considering taking some profits if not most of them. While dividend stocks still seem favorable buying them now is not a good idea. Inflation has been dropping since last year and was reported at 1.6% for the month of January. While deflation may not be in the radar inflation has stayed fairly low during the past year making cash not that bad of an idea for the short term. Although the Dow set an all time high the Volatility Index (^VIX) has not made a new all time low. The VIX failed to make an all time low in October 2007 and then the S&P 500 (^GSPC) and Dow both came tumbling down. Will the same be true this time around?

Sunday, March 3, 2013

The Facts and Financial Impact of Brain Tumors

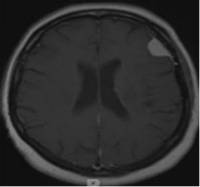

According to the National Brain Tumor Society over 688,000 people are living with primary tumors of the brain and central nervous system in the nation. Of these 138,000 are malignant and 550,000 are nonmalignant tumors. That number has increased from 612,000 in 2004. Metastatic tumors originate in other parts of the body and then may spread to the spinal cord or brain but primary tumors of the CNS originate in the brain or spinal cord. Brain tumors are usually treated by surgery, radiation therapy or chemotherapy. There has not been much progress in finding new treatments.

The American Cancer Society's statistical figures indicate that about 23,100 malignant tumors of the brain or spinal cord will be diagnosed in 2013, in the U.S. this figure includes both adults and children. In adults a meningioma is the most prevalent type of brain tumor and a glioblastoma is the most common and deadliest primary malignant brain tumor. The second leading cause of cancer deaths in children are brain tumors.

In a 2006/07 survey study The National Brain Tumor Foundation found that many patients that are diagnosed with a brain tumor undergo deep financial burdens. The financial impact can be felt by the whole family as many tumor survivors may not be able to return to work. Medication costs and high insurance premiums were a major concern. Even when patients were out of treatment they were still spending anywhere from $250-$1000 in out of pocket expenses each month. Although 91% of the patients were employed before being diagnosed only 33% were employed after being diagnosed. Caregivers continued working in larger numbers only 16% quit their jobs. There was a 300% increase in the amount of people reporting to be in the lowest income bracket post-diagnosis. Over the long term it appears that few were prepared for the high costs of brain tumor treatment and beyond. Some patients and their families had to sell their cars, take on credit card debt, cash in on retirement savings and even sell their homes.

Patients with brain tumors should feel free to ask social workers at their medical institution for assistance in regards to their financial inquiries. The National Brain Tumor Society lists a few organizations that can give some financial support such as the American Cancer Society.

The American Cancer Society's statistical figures indicate that about 23,100 malignant tumors of the brain or spinal cord will be diagnosed in 2013, in the U.S. this figure includes both adults and children. In adults a meningioma is the most prevalent type of brain tumor and a glioblastoma is the most common and deadliest primary malignant brain tumor. The second leading cause of cancer deaths in children are brain tumors.

In a 2006/07 survey study The National Brain Tumor Foundation found that many patients that are diagnosed with a brain tumor undergo deep financial burdens. The financial impact can be felt by the whole family as many tumor survivors may not be able to return to work. Medication costs and high insurance premiums were a major concern. Even when patients were out of treatment they were still spending anywhere from $250-$1000 in out of pocket expenses each month. Although 91% of the patients were employed before being diagnosed only 33% were employed after being diagnosed. Caregivers continued working in larger numbers only 16% quit their jobs. There was a 300% increase in the amount of people reporting to be in the lowest income bracket post-diagnosis. Over the long term it appears that few were prepared for the high costs of brain tumor treatment and beyond. Some patients and their families had to sell their cars, take on credit card debt, cash in on retirement savings and even sell their homes.

Patients with brain tumors should feel free to ask social workers at their medical institution for assistance in regards to their financial inquiries. The National Brain Tumor Society lists a few organizations that can give some financial support such as the American Cancer Society.

|

| Convexity Meningioma |

Subscribe to:

Posts (Atom)